What is tax deductible in your journey?

It is tax season, and many of you on your infertility journey may wonder what you can claim!

Please keep in mind that you must itemize your return to deduct your travel and medical expenditures! The following is a small list of items that can typically be included in your tax deductions:

- Uncovered medical costs – any portion covered by your insurance cannot be claimed

- IVF Consultations

- Physical examinations

- Pregnancy test kits

- Prescribed IVF medications

- Egg retrieval costs

- Embryo transfer costs

- Transportation costs when traveling to another city if the trip is essential to receiving needed medical services.

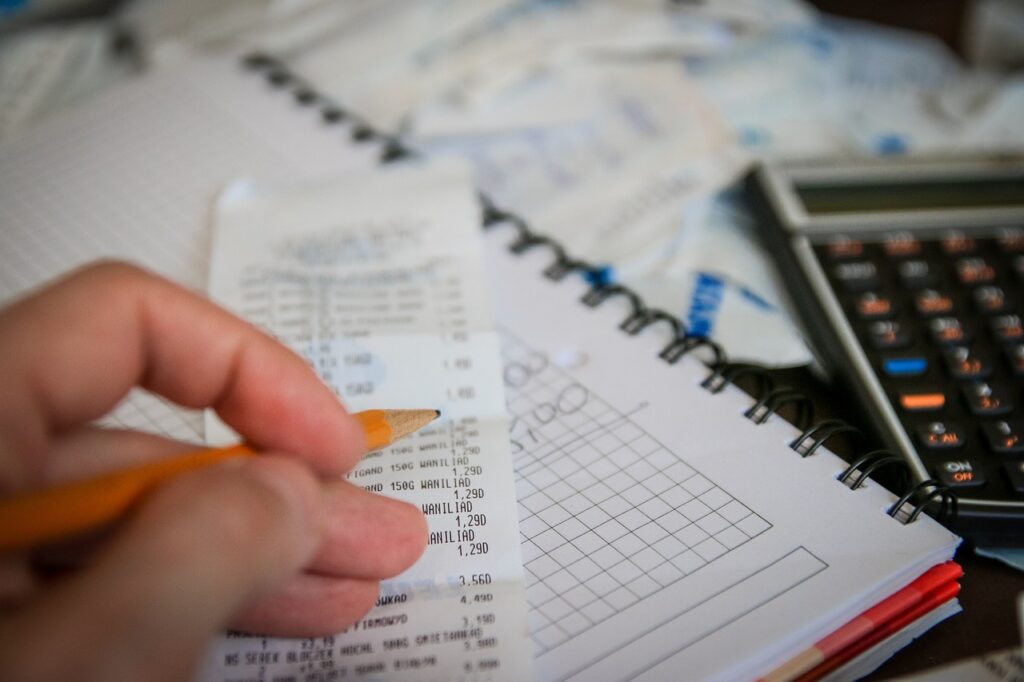

It is critical that you maintain documentation while itemizing deductions from your IVF journey. You should keep a folder exclusively for receipts, invoices, benefit explanations, and statements.

You can learn more by reviewing the IRS’ 2024 Publication 502, which details medical and dental expenses that can be claimed on your tax return.

An Eggceptional Match does not represent that we are tax attorneys or possess any credentials that would qualify us as financial or tax advisors. Nothing included in this document should be taken as tax advice. All concerns or questions should be communicated directly with your licensed tax professional.